In our last macro newsletter we discussed the case for inflation and touched on commodity prices as a potential source of cost-push inflation. In this newsletter we take a deeper dive into this asset class and provide an overview of the various types of commodities.

Subscribe now to never miss an update.

We are excited to announce a collaboration with Oraclum Intelligence Systems in organizing a competition between traders over predicting the values of selected indices, asset prices, yields and currencies at the end of the trading day each week. Every month, Oraclum will award the top 3 performers with $100 each!

The first survey begins today and closes at 8am EST tomorrow. Hit the link below to sign up.

Commodities - An Overview:

Source: Bloomberg

Inflation concerns are on the rise as the Bloomberg Commodity index has soared to levels not seen since 2015. With strong anticipated global growth and supply chain disruptions arising from the COVID-19 pandemic, Goldman Sachs expects commodities to rally another 13.5% over the next six months, with Brent Crude hitting $80 a barrel, gold at $2,000 an ounce and copper at $11,000 a tonne. But what are the various commodities, and how do their respective markets work?

There are three main categories of commodities:

Metals

Energy

Agriculture

In the following section we provide a brief outline and explore the various drivers for each commodity.

Metals:

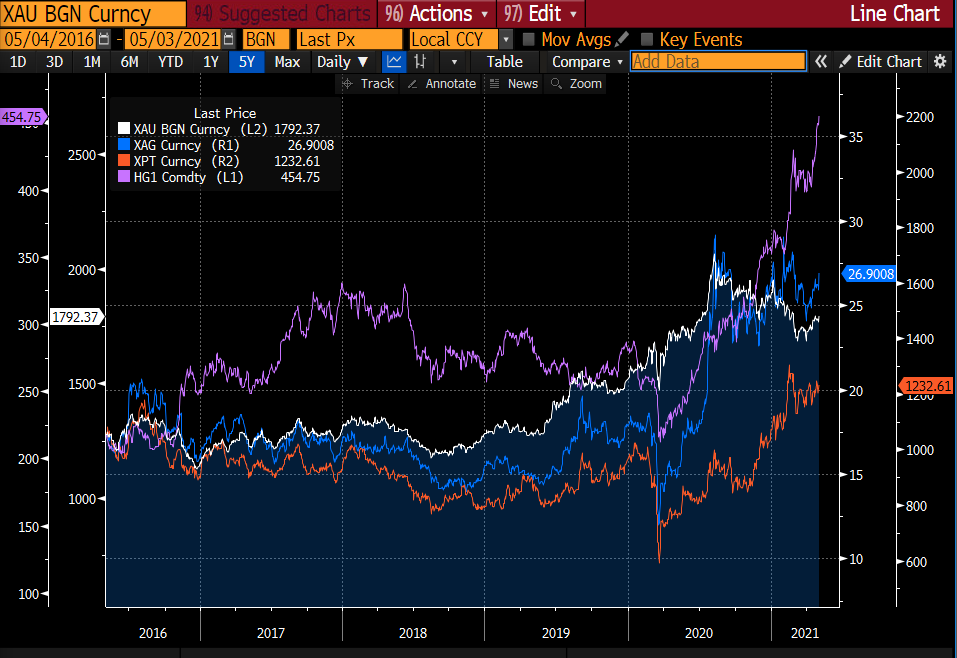

Source: Bloomberg

The key metals include:

Gold: Gold has a long history of acting as a safe-haven asset during times of volatility and a store of value during periods of inflation. The key drivers of gold prices include monetary policy, economic fear and expected inflation.

Silver: Unlike gold, the price of silver is also determined by its role as an industrial metal. As such, while it will largely trade in line with the price of gold as seen in the chart above, it exhibits more fluctuations due to changes in demand from the metal’s use in batteries, superconductors and microcircuits.

Platinum: Actually much rarer and more volatile than gold, platinum’s price is largely determined by industrial demand from the automotive industry due to the precious metal’s usage in catalytic converters. However, platinum’s use in cars is being challenged by its less expensive sister palladium, which is also more durable.

Copper: A good barometer for the strength of the global economy, copper prices are predominantly driven by emerging markets and the U.S. housing market, with the metal commonly used in electrical wiring, roofing, plumbing and insulation.

The combination of strong anticipated growth, expected inflation and President Biden’s infrastructure plan has created a perfect storm for a metals rally, providing a compelling bull-case for each of these commodities. Gold is a store of value during periods of inflation, copper and platinum are rallying due to strong industrial demand, and silver is climbing due to a combination of the two factors.

Energy:

Source: Bloomberg

Crude oil is a naturally occurring fossil fuel typically extracted through drilling, which is then refined to produce gasoline, diesel, kerosene and other petrochemicals. As with other commodities, oil prices are determined by supply and demand….

Supply is driven by the OPEC cartel formed of oil-rich countries including Saudi Arabia, Iran and Venezuela who can control supply. Non-OPEC oil influences include Russia, the U.S., Canada and China. Supply can also be determined by exogenous shocks such as natural disasters. Demand for oil is driven by the U.S., European and Chinese economies which consume more than 45 million barrels of crude a day.

In March 2020, Saudi Arabia initiated an oil price war with Russia leading to a 65% quarterly decline in the price of crude oil. Falling demand due to the COVID-19 pandemic concurrent with spare storage facilities diminishing due to excess supply culminated on April 20th with the price of oil (measured by the WTI index) briefly turning negative.

Brent crude is currently trading at ~$67 a barrel. Goldman Sachs is predicting Brent to hit $80 a barrel within the next six months, spurred on by economic reopening driving greater energy usage and an unleashing of pent up travel demand. However, oil prices could equally be hit by increased supply from OPEC ramping up production and U.S. shale wells drawing from spare capacity.

Agriculture:

Source: Bloomberg

You probably don’t think of these much, but agricultural commodities are also publicly traded and include:

Wheat: Used for animal feed and flour for pasta, bread and other foods, futures for this staple commodity are traded on the Chicago Board of Trade in lots of 5,000 bushels. The most active months for delivery are are March, May, July, September, and December.

Wheat prices are driven by several key factors on the supply and demand side including population and income growth, energy costs (fertilizer production requires natural gas), the price of other substitutes like corn, inventory levels, and the weather.

Corn: Not only is this grain used for animal feed and human consumption, it's also increasingly used for ethanol production as energy prices rise. As with wheat, corn contracts are for 5,000 bushels and the most active delivery months are March, May, July, September, and December.

Corn prices are not only driven by factors like the weather and global income growth, they are also heavily influenced by demand from the ethanol market and crude oil prices as the grain is increasingly used for biofuel production.

Soybeans: This grain is the most popular oilseed product, used in animal feed, human foods such as margarine and mayonnaise, and industrial uses such as biodiesel, particleboard and solvents. They are also traded in the 5,000 bushel contract size and the most active months are January, March, May, July, August, September, and November.

As with other crops, soybean prices are heavily driven by energy costs, the weather and global demand. However, as the most important protein source used to feed animals, soybean prices are moreover influenced by increased protein demand across Asia as consumers switch from a rice-dominated diet to one including beef, poultry and pork.

Corn, soybeans and wheat are all hitting multi-year highs amid supply issues following a record cold snap and drought in Brazil. Demand is set to surge too, with economies reopening worldwide and extremely strong Chinese orders.

Lumber:

Source: Bloomberg

As the commodity most integrally linked to manufacturing and the housing market, Lumber deserves its own section. Lumber is either classified as hardwood or softwood. Softwood is easy to saw and nail and is commonly used for putting up buildings as well as making furniture and paper. Hardwood is typically used for higher end products like expensive furniture, cabinets and flooring.

The new homes built in the U.S contain on average 16,000 board feet of lumber, and accordingly, the biggest driver of lumber prices is the housing market. Prices are also driven by supply side factors including deforestation, natural disasters like wildfires, and trade policy.

Lumber prices seem to be hitting new all-time-highs almost daily, spurred on by strong demand from the construction industry and strong housing data met with tightening supply due to shut down. All this has been amplified by rising input costs for labor and transportation as well as U.S. input duties on Canadian lumber which were raised several years ago.

Things We’re Reading:

“The Commotion in Commodities” - Kyla Scanlon

“(Don’t) Fear the Reaper. How inflation can destroy returns” - GRIT Capital

“How Market Capitalization Works (And a Look at Rolling Bubbles)” - Lyn Alden

“Crop Prices Soar to 8-Year High, Renewing Food Inflation Fears” - Bloomberg

“Rising commodity prices put pressure on European stock rally” - Financial Times

Disclaimer: All material presented in this newsletter is not to be regarded as investment advice, but for general informational purposes only. You are solely responsible for making your own investment decisions. Owners of this newsletter, its representatives, its principals, its moderators, and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission or with any securities regulatory authority. By reading and using this newsletter or using our content on the web/server, you are indicating your consent and agreement to our disclaimer.

Great piece!

Much informative information, and with the inflation narrative picking up pace, Goldman’s estimate might occur sooner than expected.